Manually tracking your business expenses and mileage can be time-consuming. That’s why using a tracker app is key.

Related article: What are Lightroom presets?

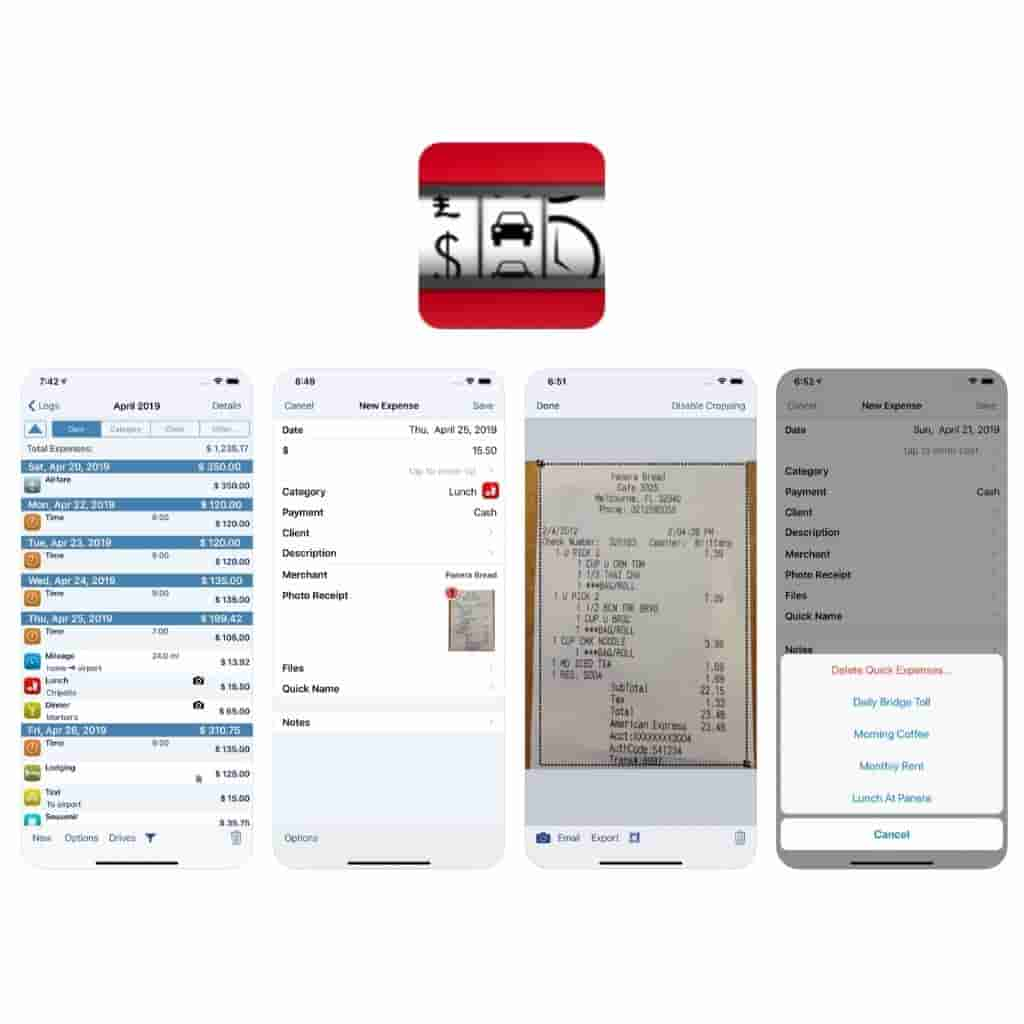

1. BizXpenseTracker

BizXpenseTracker is developed by Silverware Software and is only available on the Apple App Store.

It’s an all-in-one app because it allows you to track expenses, mileage, and time.

You can create customized categories and sub-categories for better organization.

It’s also easy to export because you can choose a PDF or CSV for Excel. Once exported, you can send it to your accountant, which they’ll love.

The app is $6.99, and it’s a one-time purchase.

Additionally, you can get the Dropbox add-on and the Optical Character Recognition (OCR) add-on, which is $1.

2. Expensify

Expensify is a powerful tool that’ll take the manual labor out of expense and mileage tracking. With Expensify, you can do the following:

- Scan receipts.

- Import credit card transactions.

- Manage corporate spend in one place.

- Reimburse expense reports as soon as the next day.

- Track expenses.

- Track mileage with GPS.

- Build custom reports.

Expensify can be found on the Apple App Store and Google Play Store.

It’s free to download, and you get 25 SmartScans per month for free, which is when it reads the merchant, date, and amount from a receipt. For the unlimited version, it’ll cost $4.99 per month.

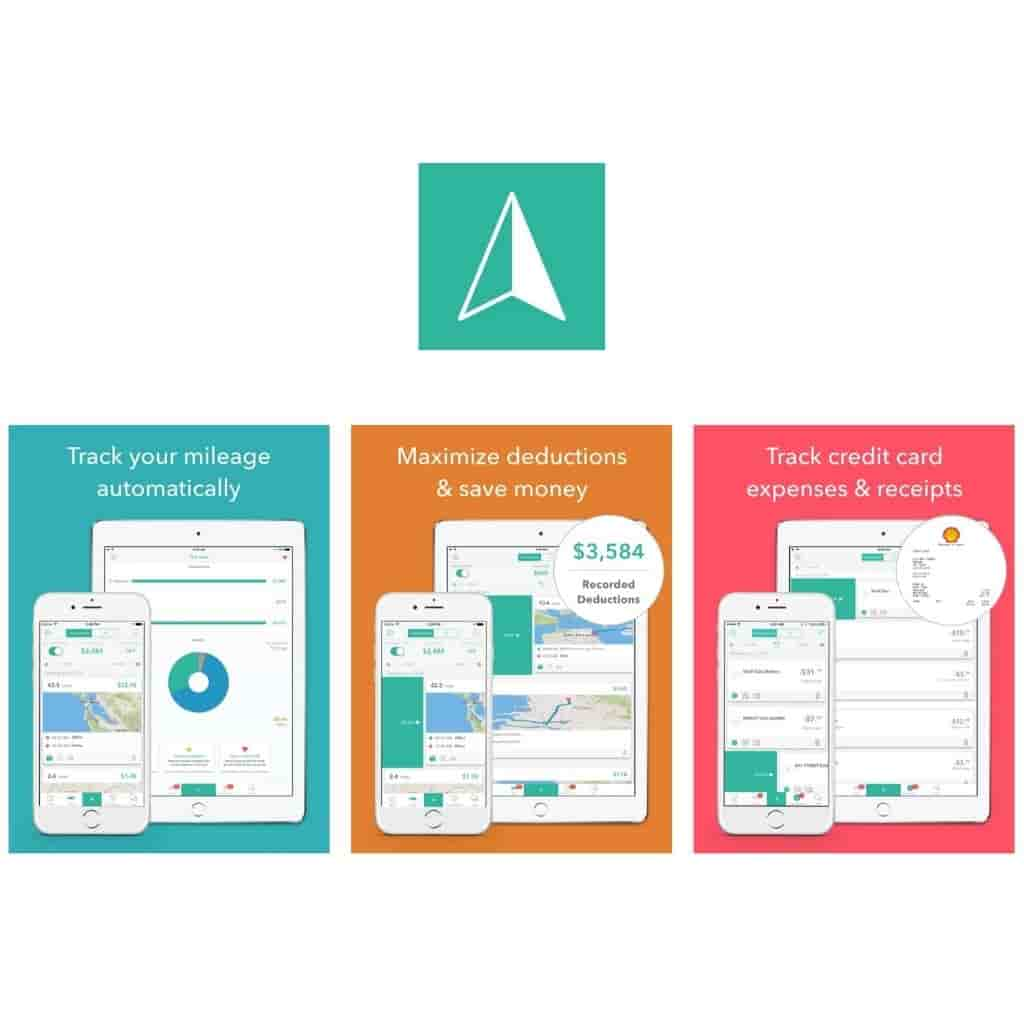

3. Everlance

Everlance is an excellent app for tracking your expenses and mileage. It uses GPS to create an IRS-compliant mileage log and connects with your bank or credit card to sync with your expenses and receipts.

It’s available on the Apple App Store and Google Play Store. The standard Everlance account is free.

However, you can upgrade to Premium for $7.99 per month or $59.99 per year.

With Everlance Premium, you get unlimited mileage tracking, advanced PDF reports, premium support, and bank or credit card integration.

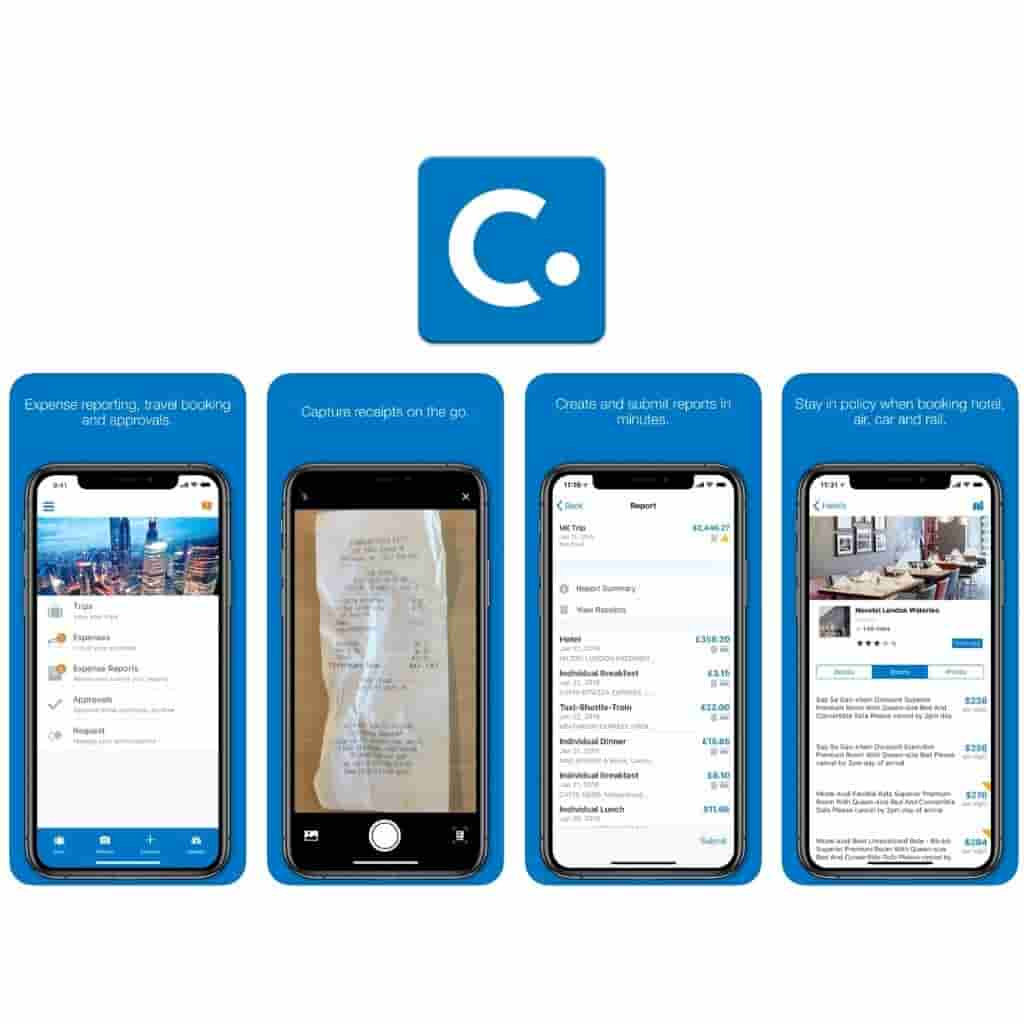

4. SAP Concur

SAP Concur simplifies travel, expense, and invoice management. You can manage the entire travel and expense process on-the-go.

It allows you to capture photos of the receipts, import transactions from your credit cards, track mileage, and easily book business travel.

It’s available on the Apple App Store and Google Play Store. You also need to be an existing SAP Concur user to utilize the app.

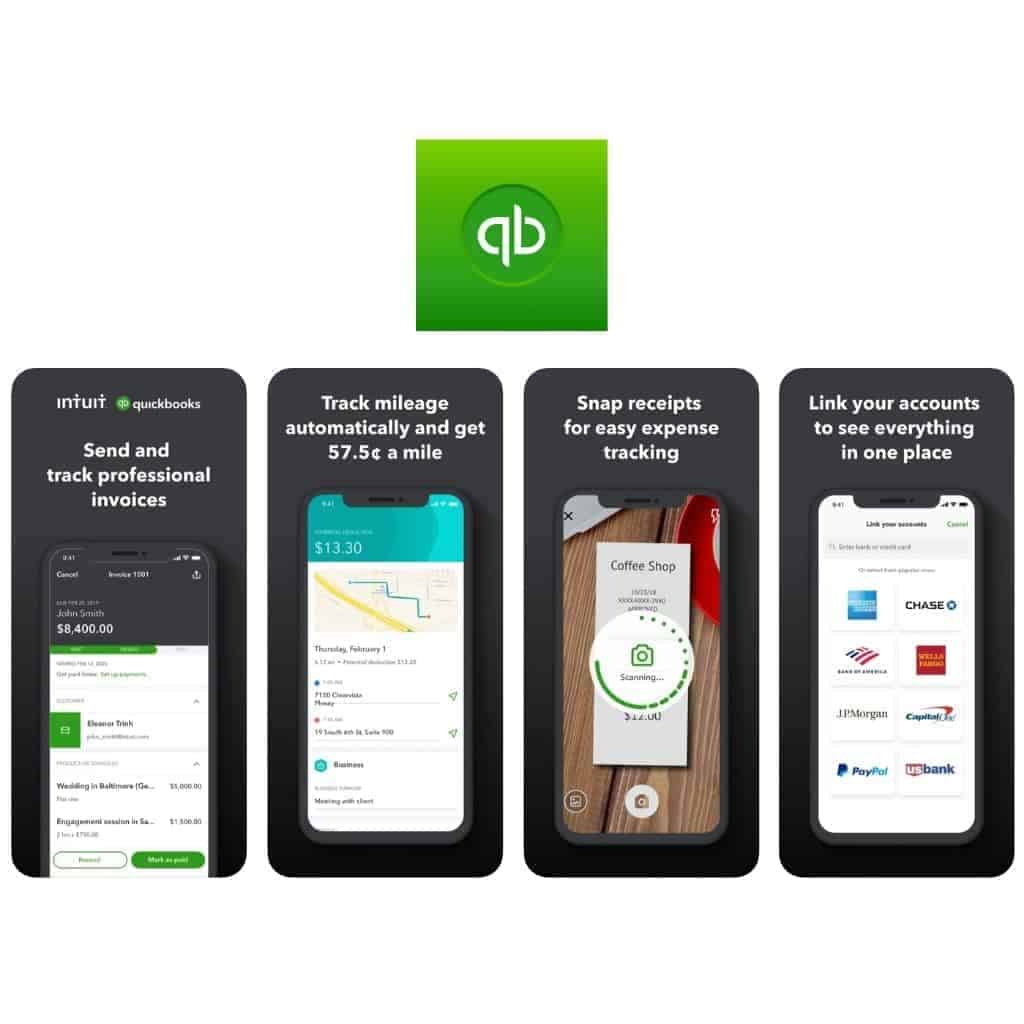

5. Quickbooks

When it comes to accounting software, Quickbooks is one of the biggest names in the market. With Quickbooks, you can do the following:

- Log miles.

- Create invoices.

- Track your transactions.

- Project profitability.

- Customizable reports.

- Great customer support.

Quickbooks is an excellent choice for photographers because it’s well-designed and flexible.

It’s available on the Apple App Store, and Google Play Store. However, make sure you sign-up online first.

Conclusion

Tracking your expenses and mileage is important for taxes and overall accounting. However, it’s also a great way to reflect on what you’re spending your money on to see if it’s helping your business. It builds your financial awareness.

Featured image courtesy of Pexels.